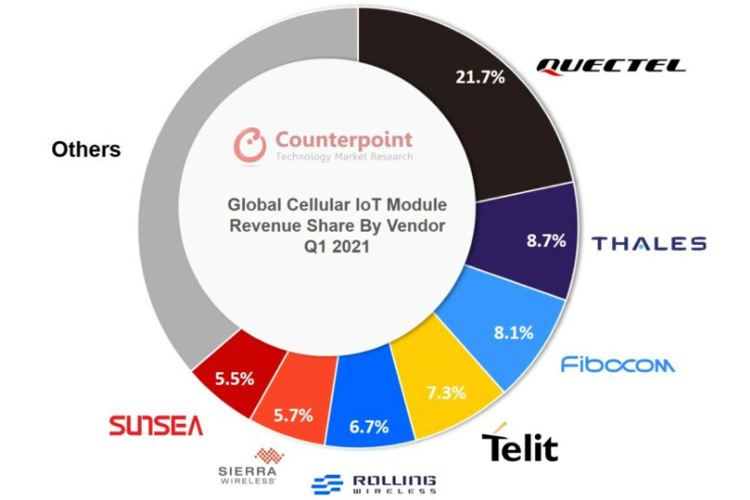

Japan, Europe, and North America registered healthy growth annually, while Latin America was the only region that did not grow in terms of revenue. 5G revenues increased by more than 80% QoQ

International research firm Counterpoint has now mentioned that the shipments of international cellular IoT modules escalated by 50% YoY and 11% QoQ during Q1 2021. During this particular quarter, the market started improving as the rate of infections caused by the pandemic were reduced globally. Japan, Europe, and North America registered healthy growth annually, while Latin America was the only region that did not grow in terms of revenue during Q1 2021. China maintained its lead across geographies with a growing demand for cellular IoT modules.

Counterpoint's research analyst Soumen Mandal said, "Quectel continues to lead the global cellular IoT module vendor rankings in terms of volume and revenue. The Shanghai-based vendor saw its shipments and revenues climb 67% and 78% respectively during the quarter. Thales continued to maintain its second position."

"5G revenues increased by more than 80% QoQ, which helped Thales decrease the gap with top-ranked Quectel and maintain the gap with Fibocom. The third-largest module vendor, Fibocom, is expanding globally beyond China with a strong focus on telematics, router, and PC segments. We can expect strong competition between Fibocom and Thales in coming quarters for the second position in terms of revenue share," added Mandal.

Vice President Research Neil Shah on the other hand clearly stated that modules based on LPWA technologies such as NB-IoT and LTE-M continued to grow above the market average, LTE-Cat 1 and 5G became the fastest-growing cellular technologies in the IoT space this quarter. This adoption has helped Qualcomm strengthen its dominant position further to capture almost half of the market in terms of volume, offering different types of cellular IoT chipset solutions to these module vendors.

Notable Vendors making strides in this market are Shanghai-based ASR Microelectronics, and Unisoc with growing design wins in the 4G Cat 1 segment. MediaTek is expected to improve its share over 4G Cat 4, 4G Cat other, and 5G technology. As IoT applications and project implementations are increasing, more chipset players are entering this space. GCT Semiconductor and XINYI Semi are the latest entrants in this segment. It will be interesting to see whether these new entrants are able to strike partnerships with larger module vendors to grow further.